quitclaim deed colorado taxes

To avoid a Colorado probate proceeding upon death Colorado real and personal property must. Beneficiary deed forms are set forth in CRS.

Quitclaim Deeds What Are They And Why Are They A Problem

You can use a quitclaim deed to.

. A quit claim deed can be obtained from an attorney a real estate agent from one of the many businesses that sell legal documents or even downloaded online. Up to 25 cash back Transfer property in Colorado quickly and easily using this simple legal form. After the deed is executed record it in the office of the county clerk where the land is situated.

A Colorado quitclaim deed form transfers whatever interest a property owner currently holds in real estate with no warranty of title. 1 A warranty of title is a real estate owners enforceable. As such that person is required to file Form 709 - United States Gift.

Transfer property to or from a revocable living trust. Start 30 days free trial. A quit claim deed is a legal document to transfer property from a grantor to a grantee in a quick manner.

For the giver the quitclaim deed is considered a gift if the transaction is not a sale. Of the Colorado Revised Statutes authorize the execution and recording of beneficiary deeds in Colorado. In Colorado a quitclaim deed is a legal document used to transfer property from an owner to a seller in an expeditious fashion.

This type of transfer comes with no warranty meaning it. Quitclaim deed colorado taxes. A quitclaim deed also cannot be used to avoid a federal or state income tax lien.

18 The filing fee includes a 300 surcharge. This deed comes with no warranty which means that it does not guarantee the titles. Many people try to avoid Colorado probate because of the perceived expense.

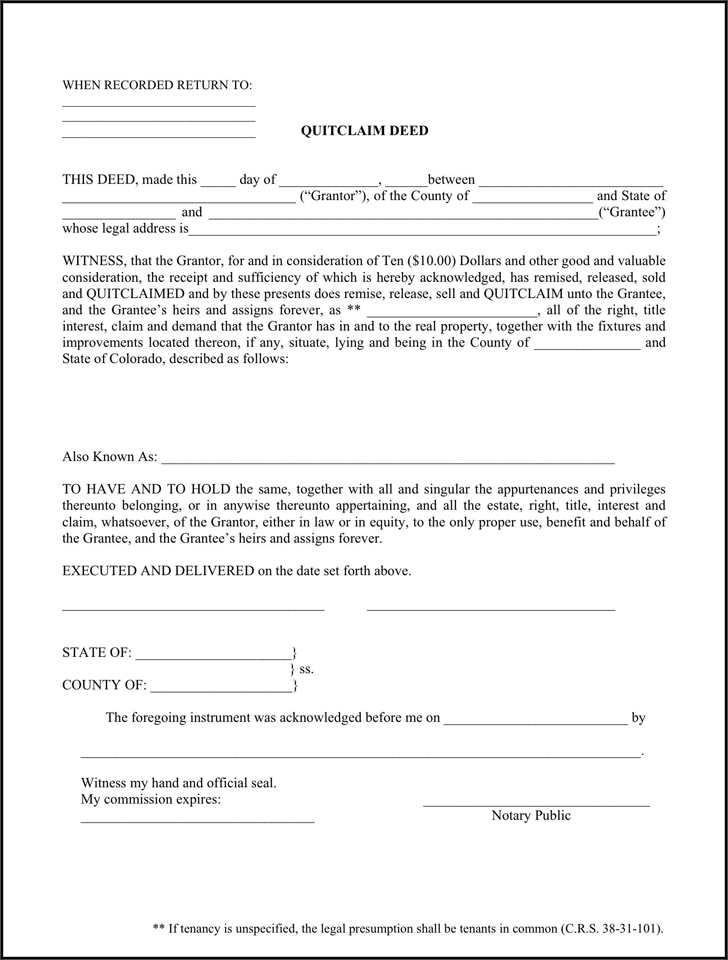

Complete edit or print your forms instantly. And QUITCLAIMED and by these presents does remise release sell and QUITCLAIM unto the Grantee and the Grantees heirs and assigns forever as _____ all of the right title interest. Section 15-15-401 et seq.

The colorado quit claim deed is a legal document that is used when a. 38-35-109 governs recording quitclaim deeds in Colorado. The person requesting recording of a Colorado deed must pay a filing fee of 1300 for the first page and 500 for each additional page.

Once a grantee accepts a property he inherits the responsibility of paying the property taxes.

Getting To Know Your Bargain And Sale Deed Legalzoom

Free Louisiana Quit Claim Deed Form Pdf

41 Free Quit Claim Deed Forms Templates ᐅ Templatelab

Quitclaim Deed Information Guide Examples And Forms Deeds Com

Quitclaim Deed Fill Online Printable Fillable Blank Pdffiller

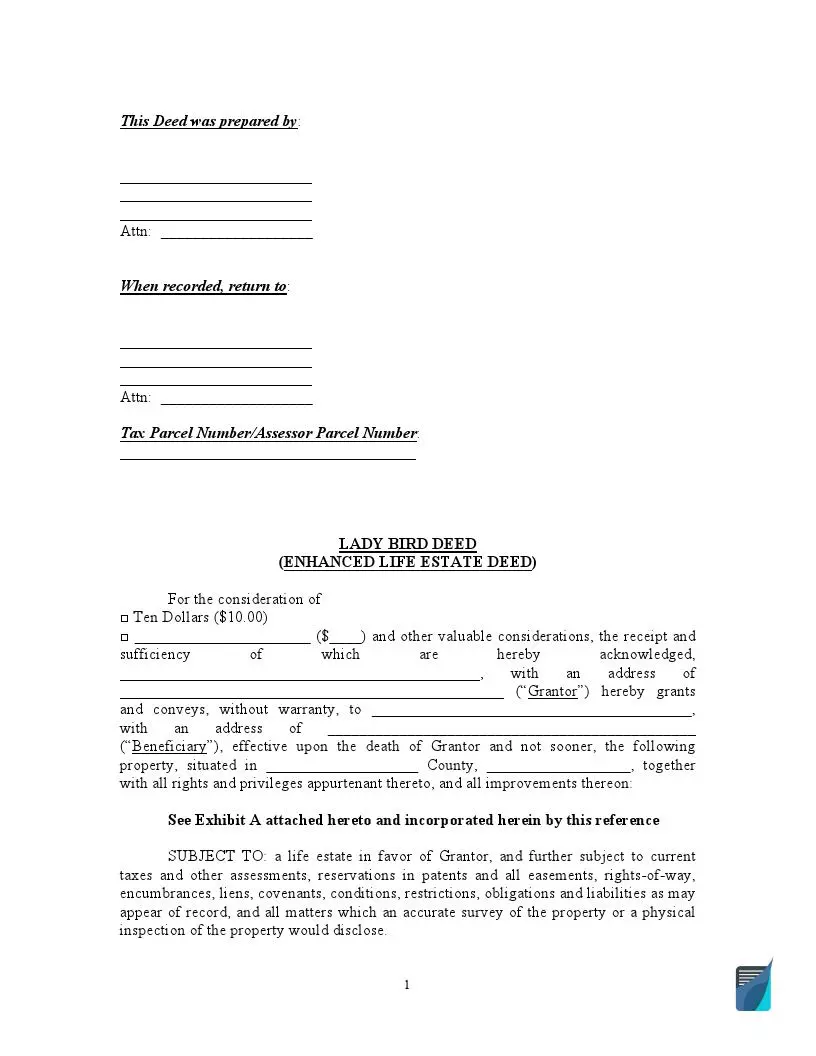

Free Lady Bird Deed Form Enhanced Life Estate Deed

20 Free Deed Forms Quit Claim Warranty Deeds Cocosign

Free Quit Claim Deed Form Pdf Word Eforms

Quitclaim Deed Colorado Signnow

Free Bargain Sale Deed Template Faqs Rocket Lawyer

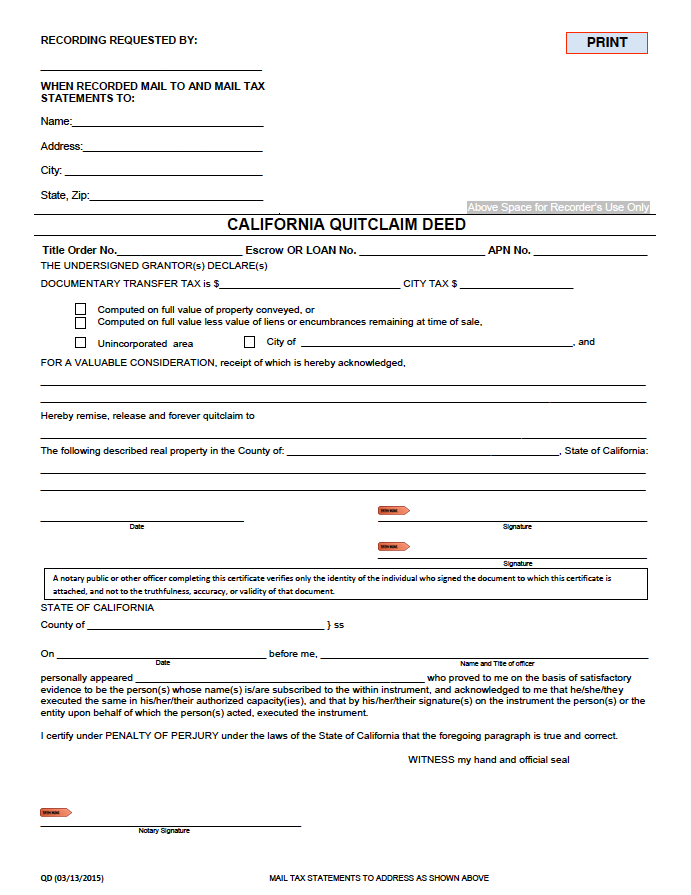

Free California Quit Claim Deed Pdf Word

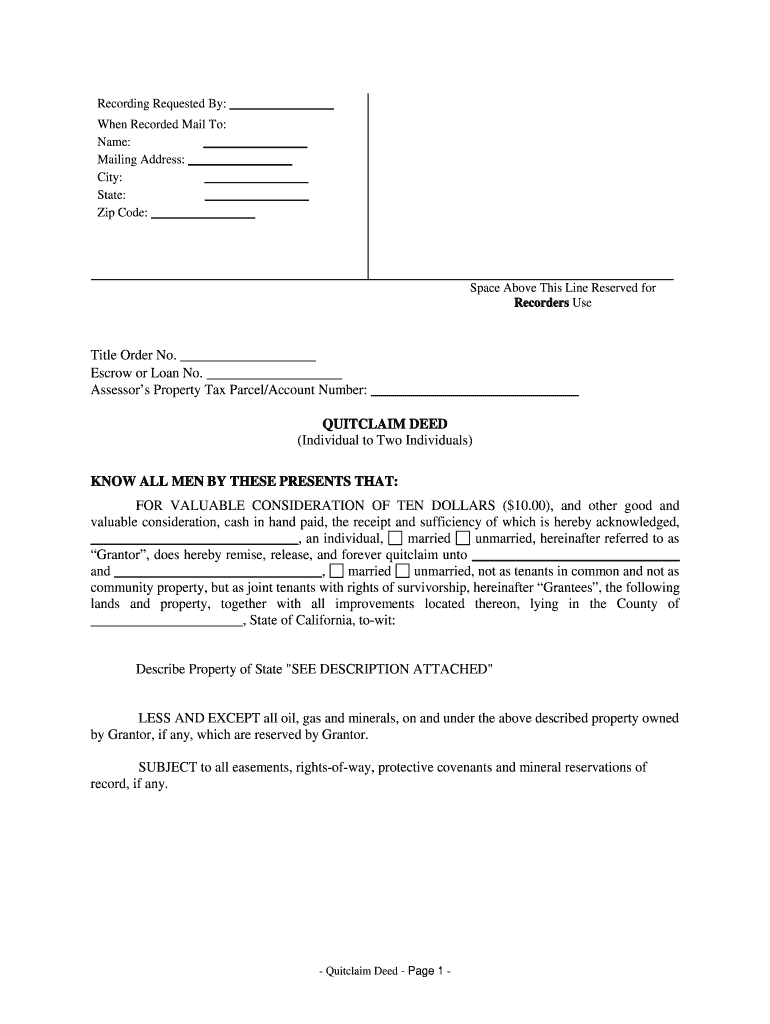

How To Fill Out A Joint Tenancy Quit Claim Deed In Oklahoma Fill Online Printable Fillable Blank Pdffiller

Free Colorado Quit Claim Deed Form Pdf Word Eforms

Free Deed Of Trust Template Faqs Rocket Lawyer

Free Colorado Quitclaim Deed Form Pdf 8kb 1 Page S

Free Quit Claim Deed Forms By State Word Pdf

Quitclaim Deed Tax Implications

What Is A Beneficiary Deed And When Should It Be Used Alpern Myers Stuart Llc Colorado Springs Attorneys